The Productivity Crisis for Loan Officers

Low-Value Tasks Dominate Daily Work

Ask any mortgage loan officer what consumes their day, and the answer will often include data entry, transcribing conversations, updating systems, and preparing summaries. While necessary, these activities are not value-generating. Research from the Mortgage Bankers Association suggests that loan production expenses have increased significantly over the last decade, with much of the rise attributable to compliance and documentation requirements.

“According to a national survey of HR leaders in the U.S., employee burnout is responsible for 20% to 50% of annual workforce turnover—and almost 10% of respondents said burnout accounts for more than half of their turnover.”

“Is employee burnout affecting your workforce turnover rate?”

— Human Resources Online, 11 April 2017

Instead of spending time advising clients, loan officers spend hours typing notes and double-checking forms. Each repetitive task compounds over time, leading to significant productivity losses across teams and organizations.

Impact on Customer Relationships and Burnout

These inefficiencies have a direct impact on borrowers. Delays in communication slow down loan applications, reduce transparency, and erode trust. Loan officers often feel stretched thin, juggling compliance obligations with client demands. The result is slower response times, increased customer frustration, and ultimately lower satisfaction scores.

Over time, these conditions contribute to burnout. High turnover among loan officers increases recruitment costs and disrupts borrower relationships. The need for a scalable, technology-driven solution is more urgent than ever.

How Helport’s AI Assistant Works

Real-Time Transcription of Customer Calls

One of the most time-consuming responsibilities for loan officers is documenting calls. Missing details can lead to compliance risks and miscommunication. Helport solves this problem with real-time transcription. Every call is automatically transcribed with high accuracy, producing instant notes that are searchable and shareable across the team.

Instead of manually typing summaries, officers can focus on listening and responding to borrowers. The system ensures that critical details—from loan amounts to regulatory disclosures—are captured precisely and stored securely.

AI-Suggested Replies and Compliance Guidance

Helport’s AI doesn’t just transcribe—it assists. During live conversations, the assistant suggests compliant, pre-approved responses based on your company’s SOPs, training data, and regulatory guidelines. This ensures that officers deliver accurate and professional replies every time.

For managers, this creates peace of mind: even new hires or less experienced staff can engage borrowers confidently, knowing that their responses align with compliance standards. For loan officers, it means faster interactions, less hesitation, and a reduced risk of errors.

Automatic Call Summaries for Faster Workflows

After each call, Helport generates a structured summary highlighting action items, key borrower concerns, and follow-up requirements. This eliminates the need for lengthy post-call documentation. Officers can immediately move to the next borrower, while managers gain visibility into conversations for training and quality assurance.

These summaries can also be integrated into existing CRM systems, ensuring that borrower records remain up to date without requiring duplicate effort.

Discover how Helport AI empowers loan officers to reclaim valuable time, cut costs, and deliver faster, compliant mortgage customer service.

Proven Impact on Efficiency

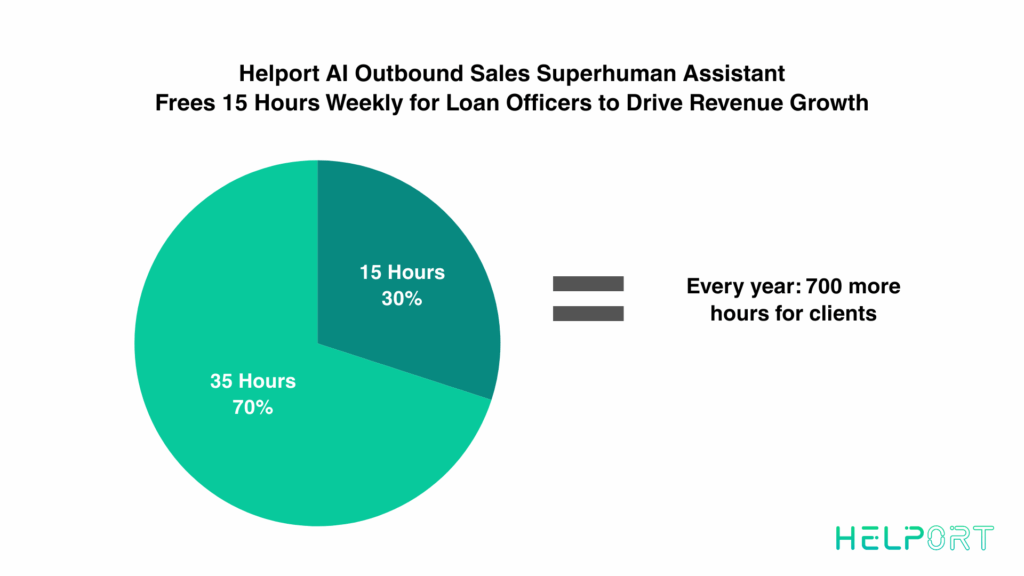

Reclaiming 700 Hours per Loan Officer Annually

By automating transcription, compliance support, and documentation, Helport frees up as much as 700 hours per year for each loan officer. That’s nearly four months of working time—time that can instead be spent advising borrowers, building relationships, and closing more loans.

At the organizational level, these gains compound. A team of 50 loan officers could collectively reclaim 35,000 hours annually, creating massive efficiency without increasing payroll costs.

The 30% Time Dividend: Let’s Do the Math

If your LO works 50 hours per week, reclaiming 30% means 15 hours back — that’s over 700 hours per year.

What could they do with that time?

- Meet more referral partners

- Deliver better client experiences

- Handle complex deals with care

- Grow your brand in-market

- Train and mentor the next generation

Better inputs mean better outcomes.

What Our Clients Are Seeing

- 📈 3x more conversions from the same lead pool

- ⚡ 40% faster first-touch response time

- 🔁 Lower LO turnover through reduced burnout

- 😊 Happier teams doing more meaningful work

30% Cost Reduction Through Smarter Processes

Operational efficiency directly translates into cost savings. Financial institutions that deploy Helport AI report reductions of up to 30% in overhead expenses tied to compliance, call documentation, and training. By reducing manual rework and errors, organizations save money and improve loan processing times.

These savings free up capital for growth initiatives, technology investments, or competitive pricing—strengthening overall market position.

Improved Compliance and Customer Experience

Helport’s AI is designed with compliance in mind. Suggested replies are filtered against your internal guidelines and external regulations, ensuring that every interaction remains compliant. This reduces risk while creating consistent borrower experiences across your team.

Borrowers notice the difference: faster replies, clearer communication, and fewer delays. Stronger customer experiences translate into higher Net Promoter Scores (NPS), improved retention, and more referrals—helping lenders grow without aggressive hiring.

Why Choose Helport for Mortgage and Lending Teams

20+ Years of BPO and Customer Service Expertise

Helport isn’t just another AI tool. Our solutions are backed by more than 20 years of business process outsourcing expertise. We understand the challenges of scaling support teams, training new hires, and maintaining compliance in highly regulated industries. This experience shapes our AI, ensuring it addresses real-world mortgage workflows.

Multilingual, 24/7 Global Coverage

Mortgage borrowers don’t always operate within business hours. Helport’s AI and agent network provide support around the clock, in multiple languages. Whether your borrowers are in New York, Singapore, or Sydney, they receive seamless communication without delays.

This global, multilingual coverage allows lenders to expand into new markets confidently, knowing that customer service quality will not be compromised.

Seamless Deployment Within 1–2 Months

Unlike traditional technology rollouts that take quarters or even years, Helport AI can be deployed within weeks. Integration with existing CRMs, telephony platforms, and compliance systems ensures minimal disruption. Our team provides white-glove onboarding, custom playbook development, and hands-on training so your staff can start seeing value quickly.

In most cases, lenders achieve full operational benefits within 1–2 months of implementation.

Book a Demo and Transform Your Lending Operations

The mortgage industry is evolving rapidly. To remain competitive, lenders need solutions that free their teams from low-value work and empower them to deliver better borrower experiences. Helport AI makes this possible.

Ready to give your loan officers 30% of their day back?

Book a Demo today and see how Helport AI transforms every conversation into measurable growth.